Renegade Raises $3.4M from Dragonfly

We’re building an on-chain dark pool, an end-to-end encrypted DEX with midpoint trades for zero price impact.

We’re excited to announce that Renegade has raised a $3.4 million dollar seed round led by Dragonfly! We are building an on-chain dark pool, delivering strong anonymity guarantees for better trade execution.

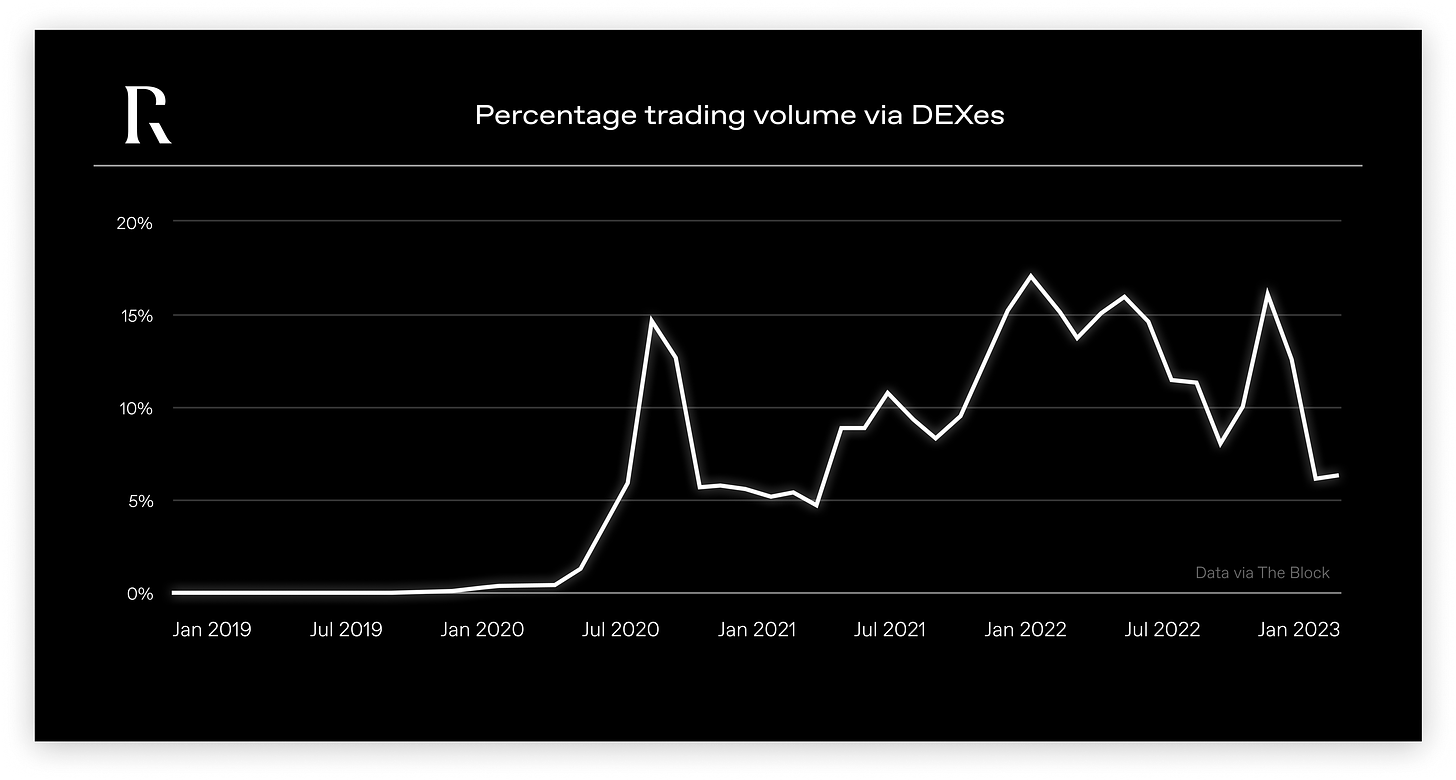

Crypto trading volume has surged over the past few years and we have begun seeing real activity inside of crypto-native DeFi protocols. However, nearly 95% of trading still happens off-chain, inside of centralized exchanges and within opaque OTC desks.

Why? In addition to historically high fees, decentralized exchanges are extremely adversarial environments, leading to worse trades for sophisticated market participants:

Atomic MEV. Trades with high slippage tolerance are prone to being atomically sandwiched, where the validator both front-runs and back-runs the trade in order to make risk-free profit.

Copy-Trading. Many different tools allow for anyone to easily scape the portfolio of any wallet addresses, making it extremely difficult to keep profitable positions private.

Counterparty Discrimination. When all past trade history is public, anyone can analyze this data to find the most sophisticated and profitable traders. This allows for discrimination in filling trades or quoting prices against these counterparties (e.g. an RFQ market maker will give bad quotes to a profitable HFT trader).

Cross-Exchange Arbitrage. When markets are very fragmented, it becomes extremely difficult to fill large size across dozens of venues: Any misstep in execution and the trader is exposed to cross-exchange arbitrage.

Statistical Arbitrage. Tools like TWAP order types are often employed to help massage orders into the market, but such trading patterns often leave traces that are detectable by arbitrage bots.

At Renegade, we are solving all of these problems by building an end-to-end encrypted exchange, a dark pool. We leverage recent advances in multi-party computation (MPC) and zero-knowledge proofs to provide the strongest guarantees of anonymity.

Just like ZCash is the anonymous network for the transfer of value, Renegade is the anonymous network for the exchange of value.

Check out our documentation to see how we leverage MPC to build a DEX with full CLOB functionality, while fully obfuscating all balances, orders, and filled trades: docs.renegade.fi

And for the most complete technical specification of the protocol, see our full whitepaper: whitepaper.renegade.fi

We’re onboarding users to our whitelisted testnet in the coming months, register here for access: renegadefi.typeform.com/access

In addition to Dragonfly and Naval as co-leads, we are backed by an amazing group of angel investors: Balaji Srinivasan (Coinbase), Tarun Chitra (Gauntlet), Marc Bhargava (Tagomi), Lily Liu (Osmosis, Solana), and Lev Livnev (Symbolic Capital Partners).

We’re excited to share more as we work towards a public testnet in the coming months. Subscribe to this newsletter for updates, and follow us on Twitter for the latest.